Working in the healthcare industry has the potential to be highly profitable, especially for physicians who can amass significant earnings while dedicated to saving and enhancing lives. However, being high-income earners, these professionals also face substantial expenses in the form of significant tax obligations throughout the year. This, in addition to repaying considerable educational debts, can severely limit their budget.

Fortunately, there are strategies to alleviate these expenses, even within the confines of a high tax bracket. Below, we will explore some tax planning tips aimed at helping physicians and other high-income medical professionals preserve a substantial portion of their hard-earned money for the future.

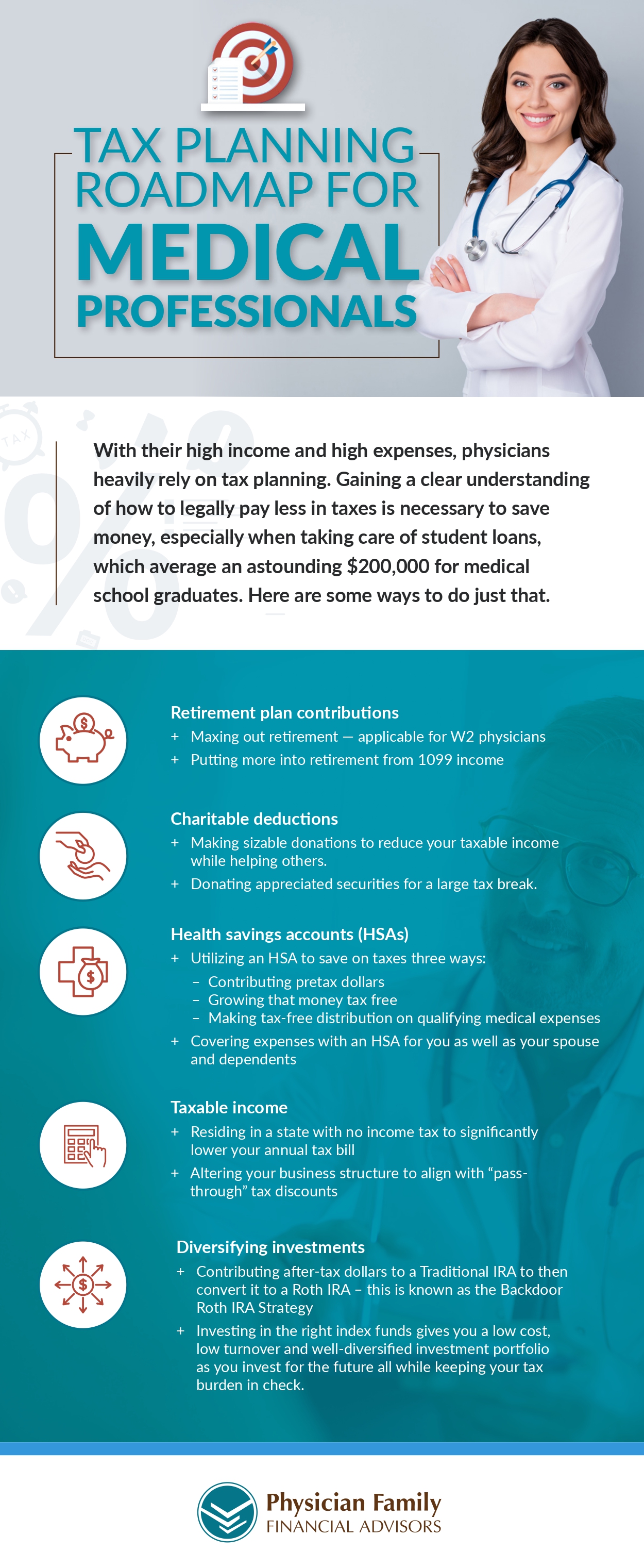

Infographic created by Physician Family Financial Advisors, physician retirement savings plans.